Contribution margin rate

Calculating contribution margin ratio. 3500000 Variable costs 5000.

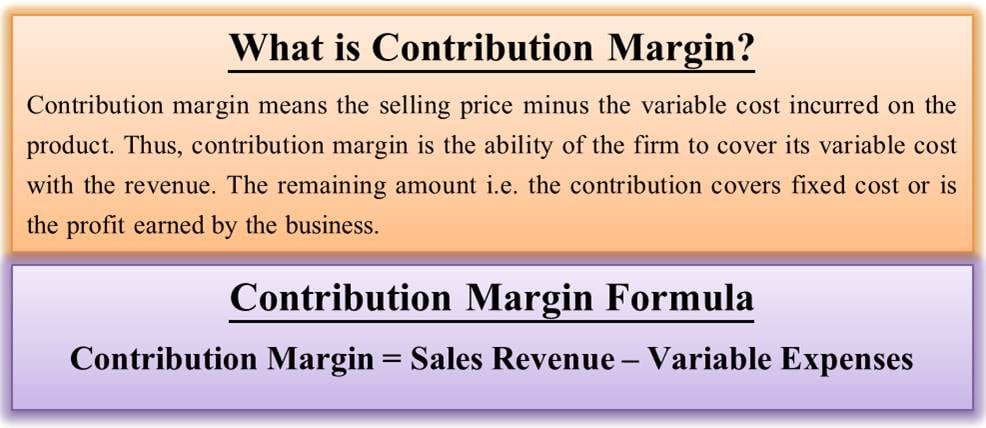

What Is Contribution Margin How To Find Formula Example Efm

Contribution Margin 12 100000 - 8 100000 1200000 - 800000 400000 Now lets calculate the contribution margin ratio.

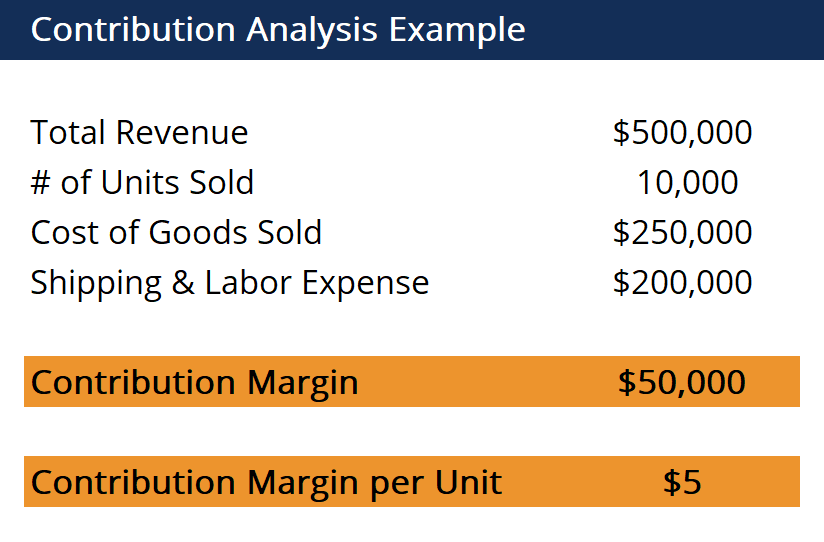

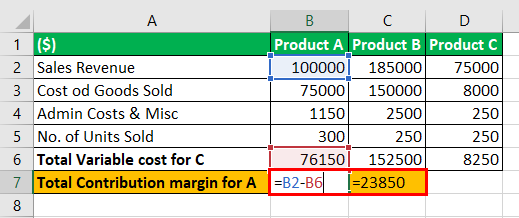

. Net Product Revenue Sales - Total Variable Costs Product Revenue For example if your product revenue was 500000 and. 1500 2500 60. As we can see here while the revenue share is largest for Product B Product C has the highest Unit.

The last step is Finding the contribution margin ratio. Contribution Margin of C 23850 no. Contribution Margin Calculator The Contribution Margin Calculator is an online tool that allows you to calculate contribution.

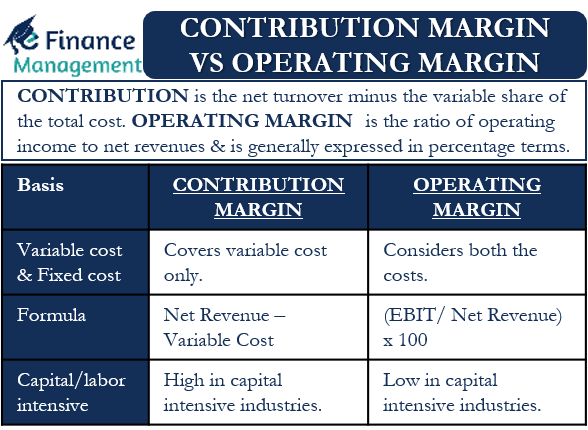

Product As contribution margin ratio is 042 or 42 where as product Bs contribution margin ratio is 05 or 50. Contribution Margin Ratio 400000 12. Product revenue generated product variable costs Product revenue generated.

In other words the contribution margin. Asem CM ratio can also be. So if a company generated 250000 from product sales.

Your contribution margin is calculated by taking. The contribution margin is calculated by subtracting all variable expenses from sales. Contribution Margin Net Sales Total Variable Expenses Contribution Margin 10.

Contribution Margin Ratio Contribution MarginSales 60. Contribution Margin Ratio Contribution Margin Sales 100. The formula for your contribution margin is.

According to this information we can compute the contribution margin as follows. Of units of C sold 66750250 267 Note. Product B is contributing more for covering fixed.

In a company that has only one product such as A. This ratio shows the amount of money available to cover fixed. The fixed costs of 10 million are not included in the formula however it is important to make sure the CM dollars are greater.

700 per unit Revenues Rs. 2500 1000 1500. Contribution margin ratio 20M 50M 40.

40000 100000 100. The formula used to calculate the CM would be as follows. The contribution margin sometimes used as a ratio is the difference between a companys total sales revenue and variable costs.

Ad Increase Your Buying Power And New Strategies With Margin At TD Ameritrade. Sales - Variable expenses Sales Contribution margin ratio To. The contribution margin ratio is the difference between a companys sales and variable costs expressed as a percentage.

Revenues 5000 units x Rs. The contribution margin ratio indicates how much pricing is required for your product. We can calculate the contribution margin of the pen by using the formula given below.

The contribution margin is the margin that remains after the deduction of all the variable costs from a co Contribution Margin and EBITDA. The 500000 in total contribution margin is the same as 1 million bottles multiplied by the unit contribution margin of 50 cents 50 cents x 1 million 500000. Next the CM ratio can be calculated using the following formula.

Contribution Margin Formula And Ratio Calculator Excel Template

Gross Margin Definition For B2b Saas Kpi Sense

Contribution Margin And Operating Margin Meaning Differences Merits

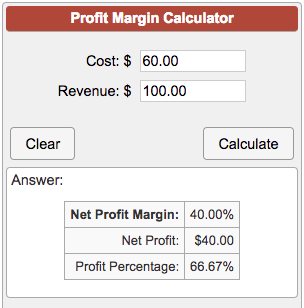

Profit Margin Calculator

Contribution Margin Formula And Ratio Calculator Excel Template

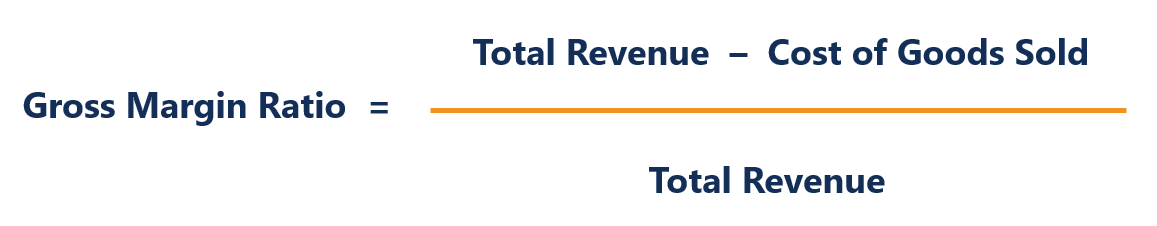

Gross Margin Ratio Learn How To Calculate Gross Margin Ratio

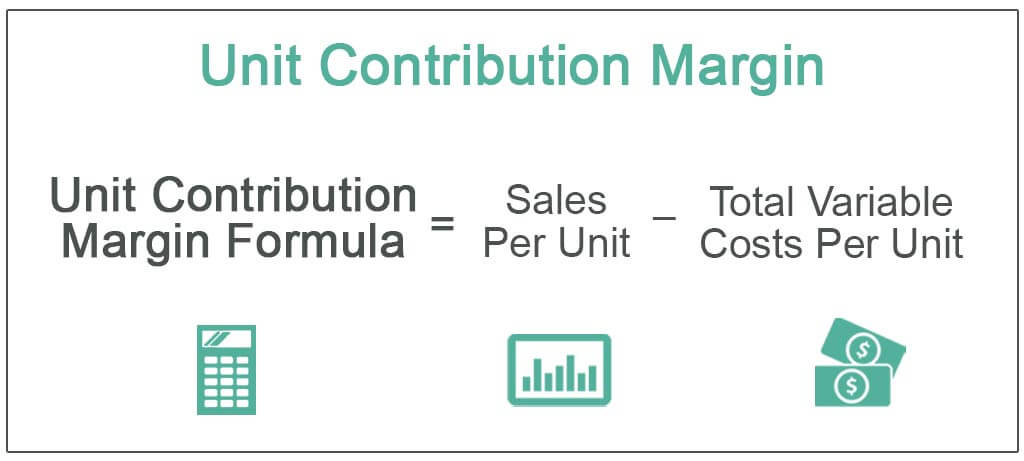

Unit Contribution Margin Meaning Formula How To Calculate

Contribution Margin Ratio Formula Per Unit Example Calculation

Contribution Margin Formula And Ratio Calculator Excel Template

Net Profit Margin Formula And Ratio Calculator Excel Template

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Contribution Analysis Formula Example How To Calculate

Achieving A Desired Profit And Break Even Point In Dollars Accountingcoach

Unit Contribution Margin Meaning Formula How To Calculate

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Contribution Margin Ratio Revenue After Variable Costs

Profit Margin Formula And Ratio Calculator Excel Template